So how do you play the uncertain election outcome?

Here’s what I’m doing in my (non-public) client portfolios. Most standard mutual funds cannot do these types of strategies. They typically fall in to the category called alternatives.

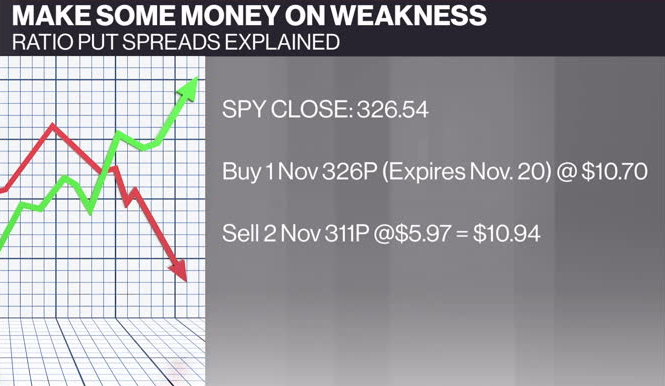

Ratio put spreads

This is a technique that allows us to make some money on weakness and buy the dip. You buy one put option on the stock or ETF you want to buy. You then sell two put options to pay for the cost of the long put position. Here is a simple example for the SPY ETF (based on prices at the close Friday Oct.30):

Your maximum profit is at 311 of $15 (about five per cent). If on Nov 20 the S&P 500 (SPY) ETF is lower than 311 you must buy 100 shares at 311. If you subtract your $15 profit, your break-even is at 296. This must be compared with being long the SPY today. You are much better off. You might ask what if I just sit in cash and wait for the dip? Answer: What if there is no dip? You structured optionality with less risk! The risk is never zero. Investing is about making bets that have the best outcome compared to doing nothing (GIC).

Let’s now look at a chart. Where would you buy it technically? Be realistic, we’d all love to buy it back at the March lows, but we can’t trade at a previous price today. The 200-day average is a bit above 312. The key retracement targets are between 272 (61.8 per cent), 288 (50 per cent), and 305 (38.2 per cent). Historically, corrections tend to move into this zone, though it depends on how strong the underlying trends are.

We know that once markets have some certainty on who is running things and how big the cheque will be, we should see the U.S. Federal Reserve step up their debt monetization and markets should rally. I’m not excited that the government needs to print money to keep the economy going, but that’s most likely what they are going to do.

Sell OTM puts to buy the dip and use premium to buy OTM calls

If the post-election uncertainty does not create a dip like this or it is less than what we expect, this strategy will capture some upside. Would you buy the market at the 200-day average (312)?

Sell the Dec. 31, 312P for $11.87. If on Dec. 31 the SPY is below 312, you must buy it at 312. Use the premium to buy a 335C for $11.73. You make money if the S&P 500 is above 335 on Dec 31. If the SPY is between 312 and 335, options expire and nothing happens, which is basically we are where we are now. No big deal.

I love option strategies when uncertainty levels are high. You can customize strategies like this to the stocks you like and the scenario you think most likely play out. You need to think of options versus either sitting in cash and doing nothing or that you would have bought the position today and held through the uncertainty. What you do really depends on your goals and ability to stick with it when markets get volatile.

This week in my Berman’s Call virtual roadshow, I will look at more option strategies on the post election outcome. If you missed one, you can see all the replays here. Sign up for the series at www.etfcm.com every Thursday at 7 p.m. ET through Dec. 3. There will be lots of opportunity to ask questions of markets and your favourite ETFs and stocks.

Subscribe to my new YouTube channel LarryBermanOfficial which is the new site for all our educational content and my new weekly market recap and ETF bull and bear picks of the week. Look for a series of option based educational videos in 2021.

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman

www.etfcm.com

from WordPress https://ift.tt/34PP3d7

via IFTTT

0 Comments